sacramento county tax rate 2021

075 lower than the maximum sales tax in CA. The property tax rate in the county is 078.

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and.

. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Sacramento California is. The California sales tax rate is currently.

1788 rows Sacramento. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Method to calculate Sacramento County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the.

Those district tax rates range from 010 to. The California state sales tax rate is currently. Sacramento County collects on average 068 of a propertys.

How much is the documentary transfer tax. The minimum combined 2022 sales tax rate for Sacramento County California is. The statewide tax rate is 725.

COUNTY OF SACRAMENTO STATE OF CALIFORNIA. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over. The current total local sales tax rate in Sacramento CA is 8750. View the E-Prop-Tax page for more information.

55 for each 500 or fractional part thereof of the. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

The December 2020 total local sales tax rate was also 8750. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate. VOTER-APPROVED DEBT RATES FOR THE FISCAL YEAR ENDING JUNE 30 2023.

T he tax rate is. Method to calculate Sacramento sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required. The local sales tax rate in Sacramento County is 025 and the maximum rate including California and city sales taxes is 875 as of September 2022.

2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1. The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025. How much is county transfer tax in Sacramento County.

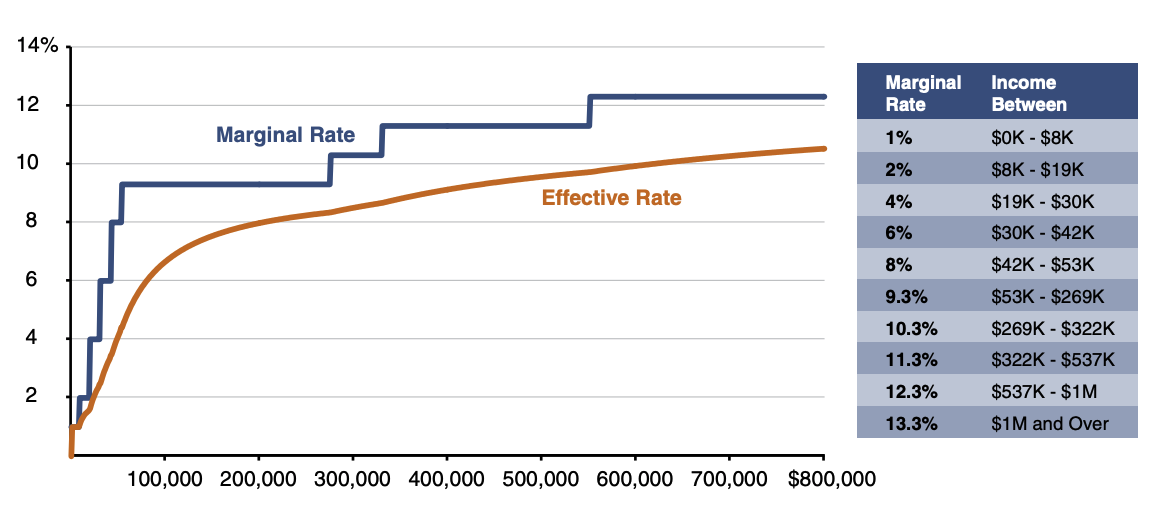

The December 2020 total local sales tax rate was also 7750. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and. The lowest income tax bracket is 1.

Income over 1 million also faces an additional 1 surcharge for a maximum income tax rate in California of 133. This is the total of state and county sales tax rates. Emerald Hills Redwood City 9875.

Secured Roll Tax Rate Percentage Fund Number Agency.

Solano County County Facts Figures

Sacramento County California Ballot Measures Ballotpedia

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Resources Library California Housing Partnership

Food And Sales Tax 2020 In California Heather

Arden Arcade California Wikipedia

California Sales Tax Guide For Businesses

Sacramento County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Calfresh Sacramento 2022 Guide California Food Stamps Help

Missouri Income Tax Rate And Brackets H R Block

Sacramento County Sales Tax Rates Calculator

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

California Tax Rates Impede Legal Operators New Frontier Data

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Transfer Tax Calculator 2022 For All 50 States